20+ Dti ratio calculator

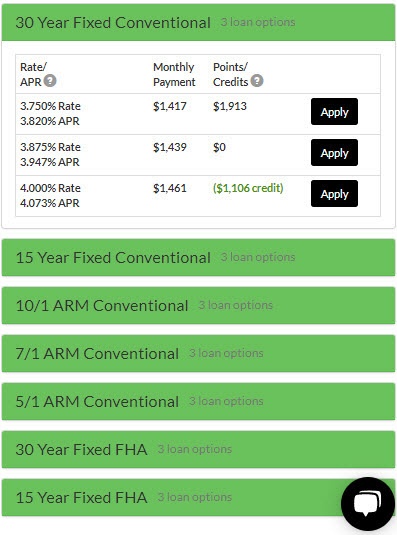

The debt-to-income ratio is one. Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3.

Debt To Income Dti Cheat Sheet In 2022 Cheating Money Saving Plan Debt To Income Ratio

You Dont Need A 20 Downpayment To Buy A Home February 20 2019 First Time Home Buyer.

. Lenders will also look at your debt-to-income ratio or DTI to get a clear picture of how risky it is to loan you money. One is to hold off on buying a home until they have a better balance of debts and income. It is recommended that your DTI should be less than 36 to ensure that you have some padding on your monthly spend.

For the required DTI ratios jumbo mortgages are the same with conforming loans. To find your debt-to-income ratio add up your loan. Historically a DTI ratio of 45 percent was the maximum acceptable DTI for Fannie Mae loans which meant it was very.

Simply put the higher your debt-to-income ratio the more the lender. The Early-2017 Guide to Buying a Home March 10 2017 Dont Have 20 To Put Down. DTI ratio reflects the relationship between your gross monthly income and major monthly debts.

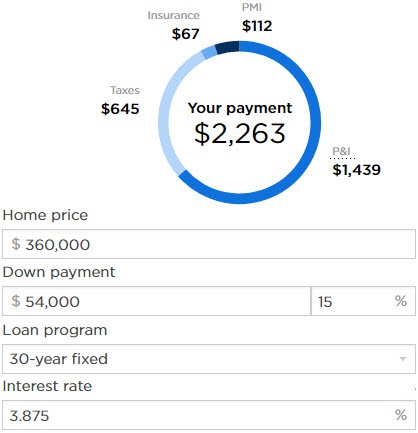

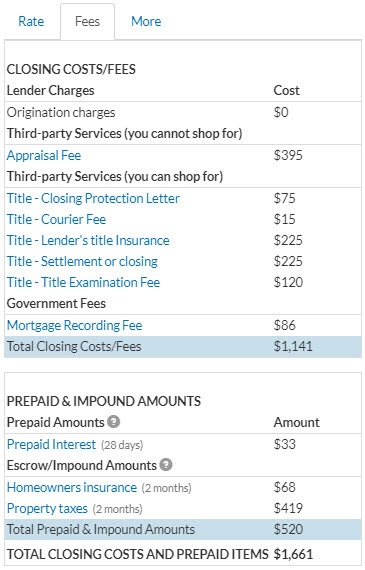

If you make a down payment of less than 20 youll pay private mortgage insurance until you reach a loan-to-value ratio LTV of 78 when you can request discontinuation of the payment. Bringing your DTI down to around 36 will improve your chances of being approved for a mortgage as well as getting better home loan terms from your lender. Conventional loan closing costs range between 2 and 5 of the purchase price.

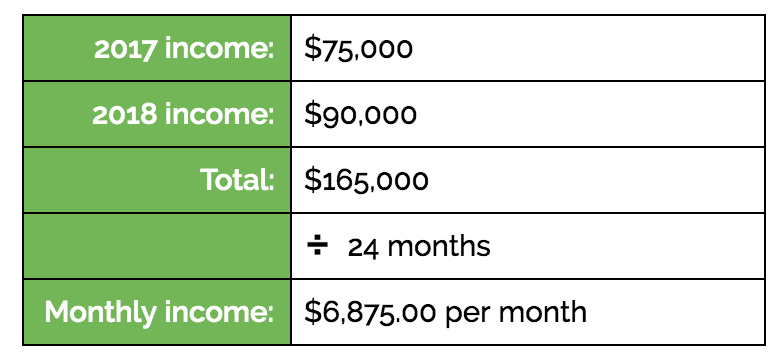

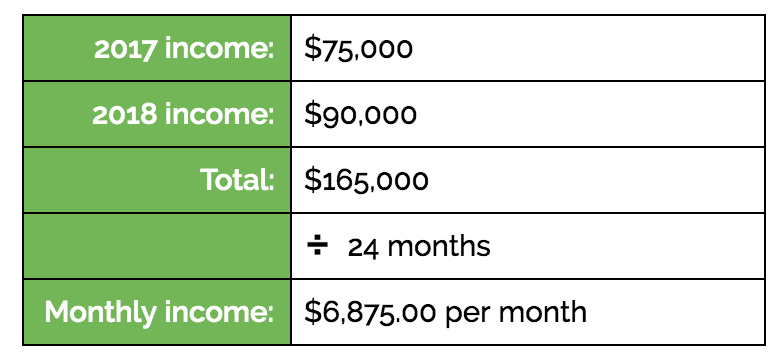

Our debt-to-income ratio calculator measures your debt against your income. To determine your DTI ratio simply take your total debt figure and divide it by your income. Monthly debt payments monthly gross income X 100 DTI ratio For example your income is 10000 per month.

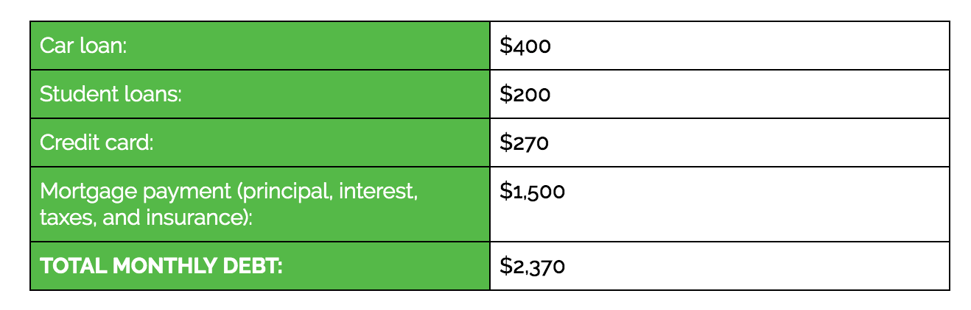

Our calculator uses the information you provide about your income and expenses to assess your DTI ratio. Home-buyers who are unsure of which option to use can try the Conventional Loan option which uses the 2836. Your mortgage property taxes and homeowners insurance is 2000.

35 of borrowers who finance put at least 20 down - about 23 dont. Historical baseline for a great home buyer who qualifies for a competitive APR. But to be safe back-end DTI should be lower at 36 percent.

A higher DTI ratio means more of your monthly pay is going toward obligations like your housing payment student loans car payment and other expenses. To borrow from your homes equity you need to have enough equity in your home. Having too high of a DTI ratio can force borrowers to make tough decisions.

And put 20 down on a home priced at the 2019 average you would need to save 76780 while obtaining a loan for 307120. Keep in mind that 43 is typically the absolute maximum DTI lenders will consider. One influential factor in determining the amount of money you can borrow on a home loan is your debt-to-income DTI ratio.

For example if your DTI ratio is too high with a 300000 loan you might be able to move forward with. Many lenders want this ratio to be less or equal to 36 of the borrowers incomeHowever conventional loans may allow a DTI as high as 43. Pool Financing is our specialty.

Your loan-to-value ratio will also determine whether you have to pay private mortgage insurance. Making backyard dreams come true is our passion. A DTI of 20 or below is considered excellent while a DTI of 36 or less is considered ideal.

Our debt-to-income calculator looks at the back-end ratio when estimating your DTI because it takes into account your entire monthly debt. Lenders want to make sure its comfortable for borrowers to pay back the amount theyre borrowingyou still need to buy groceries after alland a DTI ratio is a good way for them to. Your estimated front and back ratio using our affordability calculator found here and your estimated annual taxes insurance and.

A good DTI greatly impacts your ability to get pre-qualified for a mortgage. A 45 DTI means your total monthly payments add up to 45 of your gross monthly income. 499 for a 20-year pool loan available for those who qualify Click Here To Apply.

Along with credit scores lenders use DTI to gauge how risky a borrower you may be when you apply for a personal loan or. Over the life of the loan you would need to repay the amount borrowed along with 286406 in interest for a total repayment of. Compare your debt-to-income ratio to our measurement standards below.

Application Form new. Some people view renting as throwing money away but even if you put 20. Another option is to seek a lower loan amount.

And since your DTI is low youre entitled to a more favorable. If your lenders DTI limit is 28 for front-end DTI and 36 for back-end DTI you have a good chance of qualifying for a mortgage. Benchmarks can vary by lender and the borrowers specific circumstances.

For example if you make 10000 per month before taxes your total monthly debt payments could reach up to. It may be possible to get approved with a debt-to-income ratio above 43. Run the numbers and assess your own DTI to get a sense of what your risk level is.

Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages. There isnt a hard cap on DTI ratio for VA loans. Requirements to Borrow From Home Equity.

In this example if you apply for a mortgage with your spouse your front-end DTI ratio will be 2053 and your back-end DTI ratio will be 3417. Use this calculator to figure home loan affordability from the lenders point of view. FHA purchase loans will allow you to have a loan-to-value ratio of up to 965 percent.

How Leveraged Are You. Debt-To-Income Ratio - DTI. Buyers whose DTI.

CFPB Shifting From DTI Ratio to Loan Pricing. A 20 DTI is easier to pay off during stressful financial periods compared to say a 45 DTI. For instance if your debt costs 2000 per month and your monthly income equals 6000 your DTI is 2000 6000 or 33 percent.

To qualify you should have already paid down at least 15 to 20 of your. The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall income. Dealing with High DTI Ratio.

They both need a front-end DTI ratio of 28 percent and a back-end DTI ratio of 43 percent. For more information about or to do calculations involving debt-to-income ratios please visit the Debt-to-Income DTI Ratio Calculator. For conventional loans borrowers who want to avoid paying private mortgage insurance will need to make a down payment of 20 percent of the value of the home.

Debt To Income Cheat Sheet In 2022 Debt To Income Ratio First Home Buyer Income

Tuesday Tip How To Calculate Your Debt To Income Ratio

Debt To Income Ratio Can You Really Afford That Car Or Home Money Life Wax Debt To Income Ratio Student Loans Student Loan Help

How Self Employed Workers Get Mortgages

3

2022 Guide To Qualifying For A Mortgage With Student Loans Find My Way Home

Fha Debt To Income Calculator Debt To Income Ratio Real Estate Advice Fha Loans

How Lenders Calculate Qualifying Income Find My Way Home

Everything About Debt To Income Ratio And How To Calculate It

1

Debt To Income Ratio Calculator Debt To Income Ratio Income Debt

11 619 Ratio Photos Free Royalty Free Stock Photos From Dreamstime

How To Get A Reliable Mortgage Rate Quote In 1 Minute

How Self Employed Workers Get Mortgages

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

How To Get A Reliable Mortgage Rate Quote In 1 Minute

How To Get A Reliable Mortgage Rate Quote In 1 Minute