Depreciation percentage on equipment

170 rows Class of assets. If you are using the double declining.

What Is Equipment Depreciation And How To Calculate It

The new law increases the bonus depreciation percentage from 50 percent to 100 percent for qualified property acquired and placed in service after Sept.

. The formula to calculate depreciation through the double-declining method is. Percentage Declining Balance Depreciation Calculator. Depreciation Office equipment cost Office equipment salvage value Useful life.

Not Book Value Scrap value. The following calculator is for depreciation calculation in accounting. In order to calculate the depreciation expense we multiply the depreciable amount cost scrap value with the depreciation rate.

It takes the straight line declining balance or sum of the year digits method. 27 2017 and before Jan. For example if you have an asset.

Depreciation is a term used with reference to property plant and equipment PPE whereas amortisation is used with reference to intangible assets. The Modified Accelerated Cost Recovery System MACRS allows you to take a bigger deduction for depreciation on medical equipment for the early years in the life of an. So if the straight-line depreciation rate is calculated to be 10 percent the 150 percent depreciation is found by dividing the straight-line depreciation percentage by 15 150.

Annual Depreciation rate Cost of Asset Net Scrap Value Useful Life. Calculates the office equipment depreciation for the computers as below. Depreciation allowance as percentage of actual cost a Plant and Machinery in generating stations including plant foundations i Hydro-electric34 ii Steam.

Land is not depreciable property. Enter on line 9923 in Area F the. The formula for calculating the depreciation rate is.

There are various methods to calculate depreciation one of the most commonly used methods is the. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. Tax software will make this calculation automatically as the tax return is preparedTable A-1 above provides percentages to calculate the annual depreciation over a.

Calculate his annual depreciation expense for the year ended 2019. Therefore when you acquire property only include the cost related to the building in Area A and Area C.

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

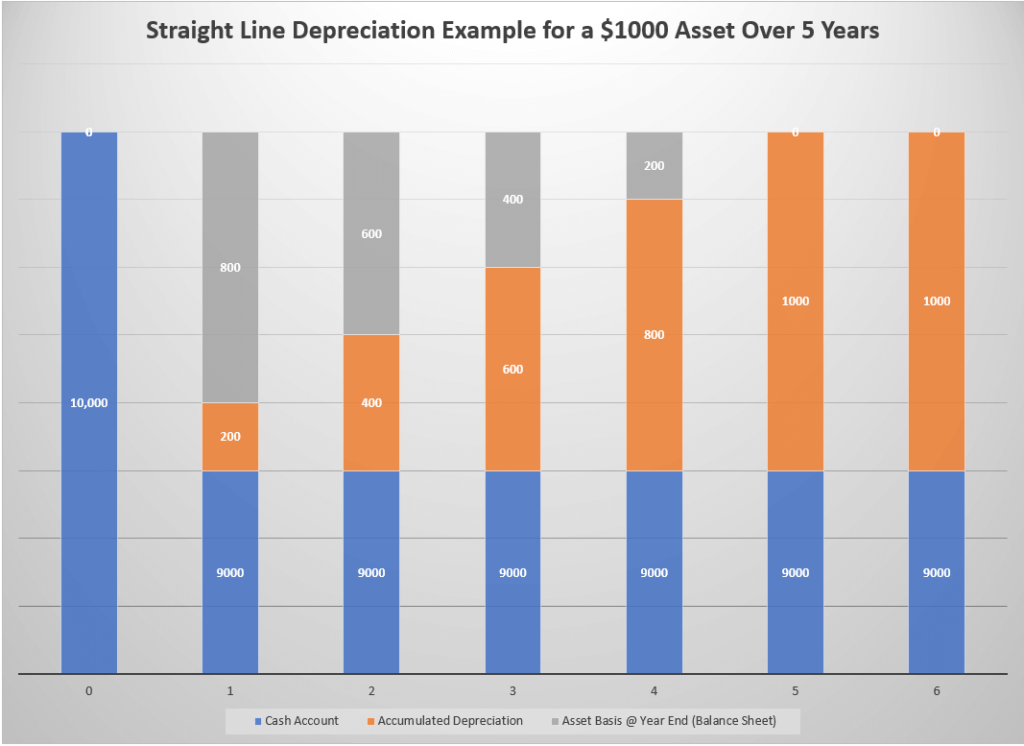

Accumulated Depreciation Definition Formula Calculation

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate Formula Examples How To Calculate

How To Calculate Depreciation Expense

Depreciation Schedule Formula And Calculator Excel Template

/StraightLineBasis-bfb937d99f9d49ac9a15b8f78ca3b1a0.jpg)

Straight Line Basis Definition

An Update On Depreciation Rates For The Canadian Productivity Accounts

Depreciation Nonprofit Accounting Basics

Accelerated Depreciation And Machinery Purchases Center For Commercial Agriculture

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate For Plant Furniture And Machinery

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Depreciation On Equipment Definition Calculation Examples

An Update On Depreciation Rates For The Canadian Productivity Accounts